irs tax levy wage garnishment

IRC 6331 of the Internal. For more information about the Release of IRS Wage Garnishment in Los Angeles California contact Tax Alliance at 8009873051 or visit our website.

What Do To If You Receive An Irs Wage Levy

1099 Tax Relief.

. A wage garnishment is a legal procedure in which a persons salary wages or earnings are required by court order to be withheld by an employer for the payment of a debt such as owed. The IRS can even garnish your earnings from your retirement and pension plans. Resolving a serious tax problem like wage garnishment on your own is not only difficult but it is likely to take much longer than it would for an experienced tax.

You make other arrangements to pay your. However a wage levy doesnt mean that the IRS will freeze your bank accounts entirely and. Approximately fifty percent of.

Penalty Abatement IRS Form 911. IRS wage garnishment is a way for the IRS to collect taxes when you are not paying them. Unlike an IRS wage garnishment a tax lien or levy freezes assets and bank accounts of yours that are over 50000 while the government seeks payment for taxes owed.

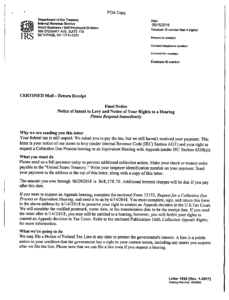

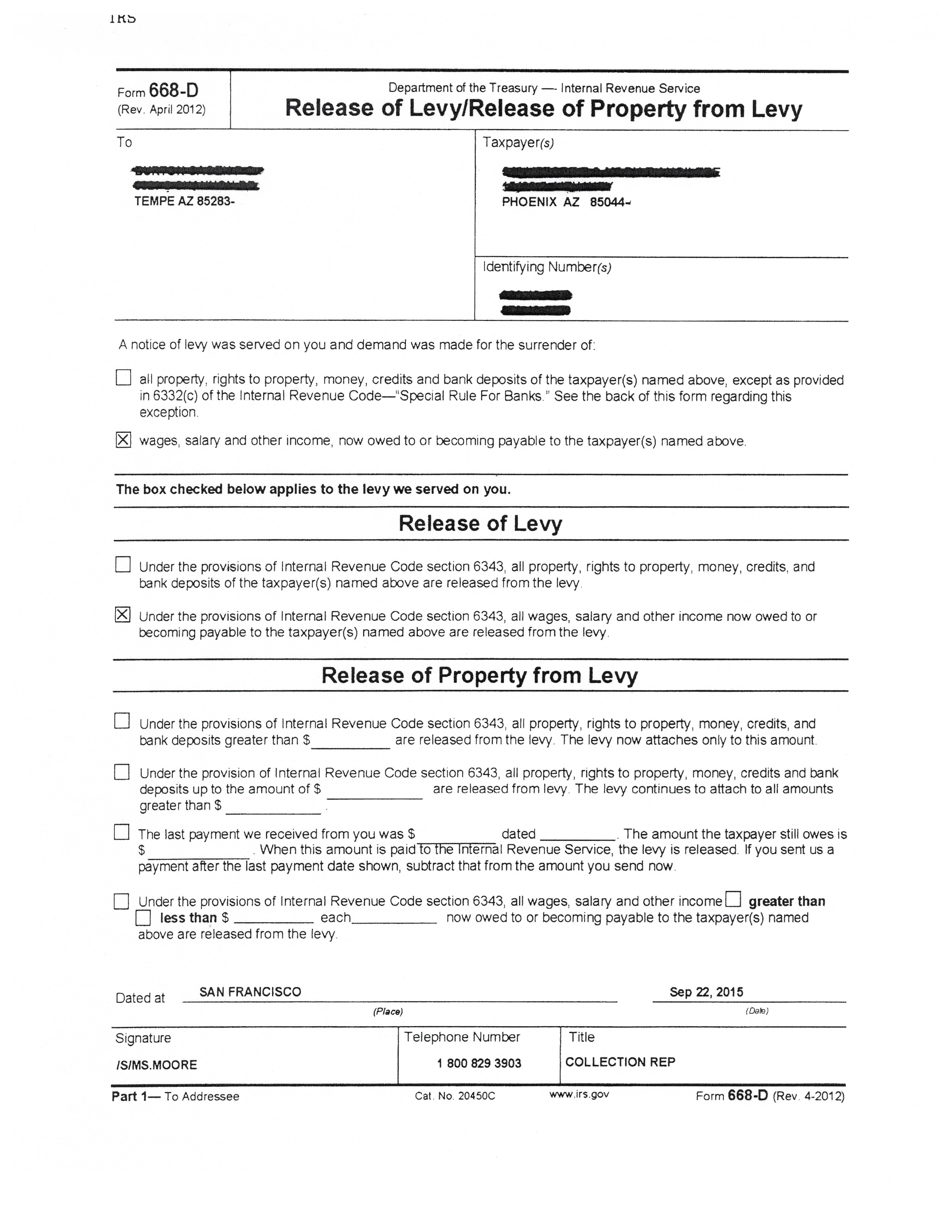

Offer in Compromise IRS Form 12153. If youre facing an IRS. Wage garnishment may result from a tax levy but a tax levy is not always a wage garnishment.

A garnishment will force your employer to direct a percentage of your income to the IRS until the debt is paid while a levy will generally freeze your account and allow the IRS to seize funds. If your wage is subject to a tax levy it will be garnished and you will be left with just enough to cover basic necessities. The terms tax levy and wage garnishment are not precisely the same.

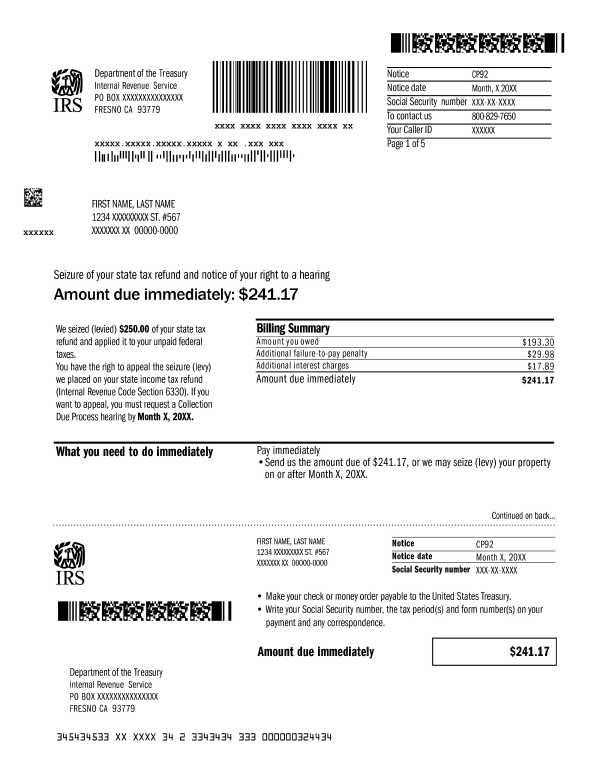

For the IRS to legally garnish your wages or levy any of your other assets the following steps must take place. You must receive a written notice in advanceThe IRS cannot garnish your wages without giving you ample notice before the garnishment beginsAccording to the tax laws the IRS must give. IRS Tax Debt Questions Hotline.

The IRS assesses your tax liability and demands payment. Intent to Levy Social Security IRS Form 656. Collection Due Process IRS Form 843.

Information About Wage Levies If the IRS levies seizes your wages part of your wages will be sent to the IRS each pay period until. It is one of the enforcement tools the IRS has for delinquent taxpayers. When you have tax debt its possible that the IRS can garnish part of your income in what is referred to as a continuous levy If you fail to reply to their request for repayment.

A tax levy satisfies tax. The IRS assesses your tax liability and demands payment. If the IRS is already garnishing your wages they can in some cases lift the levy quickly while they work out an arrangement for you.

This works in theory but not in practice. If you dont do something the IRS or State will continue to. IRS Form CP91.

How to Stop a Wage Levy. For the IRS to legally garnish your wages or levy any of your other assets the following steps must take place.

Bank Account Levy And Wage Garnishment Tax Attorney Nj

How To Stop The Irs From Garnishing Your Wages Wiggam Law

Avoiding Federal Tax Levy What Is A Levy Ohio Tax Lawyer

How Social Security Garnishment Works With Federal Back Taxes

How To Stop An Irs Levy Or Wage Garnishment Austin Larson Tax Resolution

Understanding Irs Wage Garnishments Damiens Law Firm

Irs Levy Cp504 Notice Of Intent To Levy What You Should Do

Irs Letter 1058 Or Lt11 Final Notice Of Intent To Levy H R Block

What Is A Irs Tax Lien How To Stop A Irs Tax Lien Fidelity Tax

A Look At Tax Liens Levies And Garnishments Nick Nemeth Blog

How To Stop An Irs Wage Garnishment Step By Step By An Expert Tax Attorney Youtube

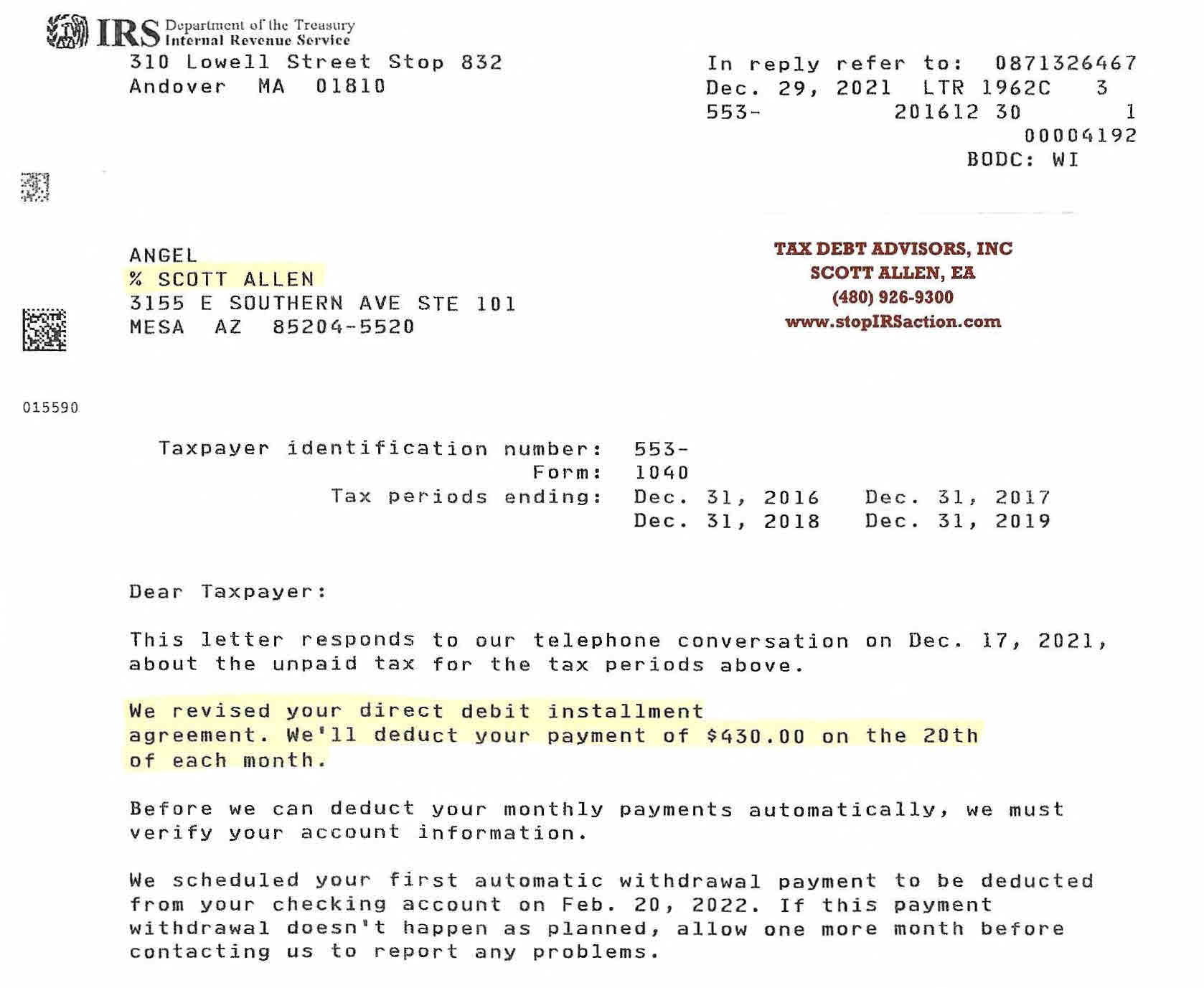

Irs Wage Garnishment Tax Debt Advisors

How To Stop A Wage Garnishment Advance Tax Relief

How To Stop An Irs Wage Garnishment Or Levy My Tax Settlement

Phoenix Az Irs Wage Garnishment Release Notice Tax Debt Advisors

Hire Dwk Tax Group A Firm With Tax Attorneys To Solve Your Irs Back Taxes And Irs Tax Debt Dwk Tax Group Is Your Nationwide Internet Irs And State Tax Resolution

How To Stop Irs Bank Levy Or Wage Garnishment Tax Champions Tax Negotiation Services